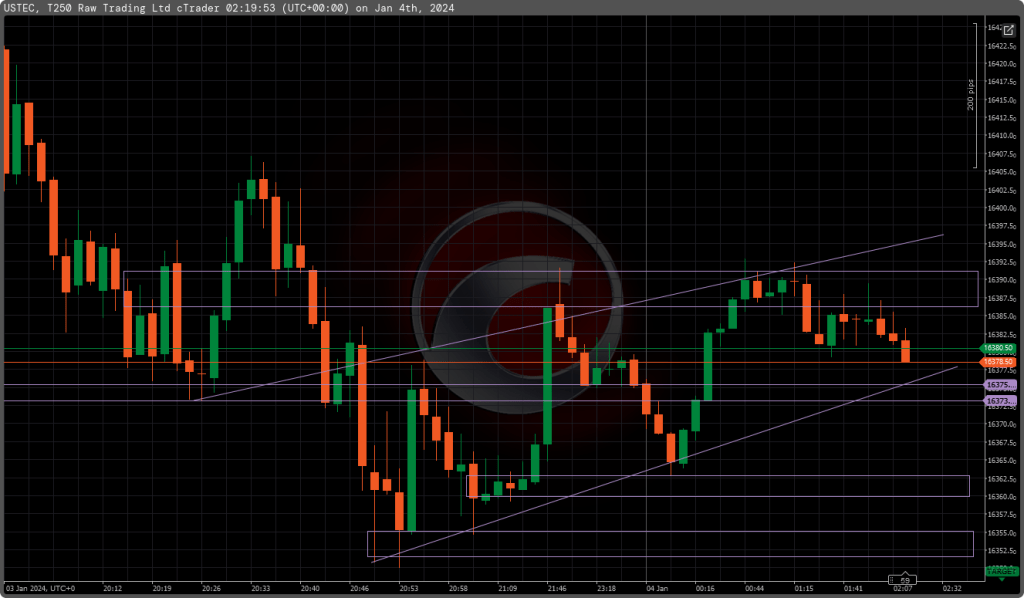

- Date of Analysis: January 4th, 2024

- Charting Software: cTrader

- Time Frame: 250 Tick Chart

Technical Indicators and Patterns:

- Support and Resistance Levels: The chart shows clear support and resistance levels. Support is observed around the 16350 price point, with resistance near the 16420 level.

- Trend Lines: Two converging trend lines suggest the formation of a symmetrical triangle pattern, indicating a period of consolidation with potential breakout or breakdown.

- Candlestick Analysis: A mix of green (bullish) and orange (bearish) candles indicates volatility and a tug-of-war between buyers and sellers.

Market Sentiment:

- The formation of a symmetrical triangle typically suggests that the market is in a state of indecision. A breakout above the resistance or below the support could determine the next significant move.

Key Observations:

- Price Consolidation: The narrowing of the price range within the symmetrical triangle suggests that a significant price move may be imminent.

- Breakout Watch: Traders should monitor for a breakout above the upper trend line or a breakdown below the lower trend line for potential trading opportunities.

- Risk Management: Due to the inherent volatility and uncertainty, traders should use appropriate risk management strategies, including stop-loss orders and position sizing.

The USTEC tick chart indicates a period of consolidation with potential for a significant price move in the near term. Traders should remain vigilant and watch for a breakout or breakdown from the current pattern to capitalize on the subsequent momentum.

Leave a comment