As the financial world eagerly awaits the release of the US Consumer Price Index (CPI) figures by the US Bureau of Labor Statistics (BLS) on Thursday, January 11 at 13:30 GMT, the air is thick with anticipation. This report, considered a crucial indicator of inflation, has gathered varied predictions from economists and researchers across ten major banks. Let’s dive into what these financial institutions are forecasting for the December US inflation numbers.

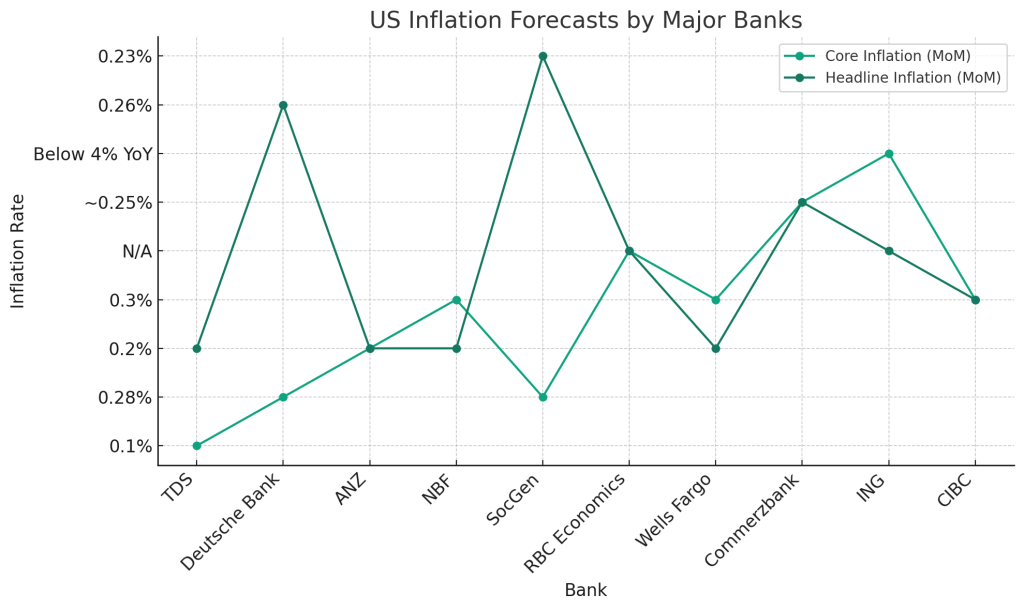

1. TDS: A Slowdown in Core Inflation TDS anticipates a decrease in core inflation to 0.1% MoM from November’s 0.3%, with headline inflation expected to see a slight increase to 0.2%. They highlight that used vehicle prices might significantly drag down inflation, while Owner’s Equivalent Rent (OER) and rents are projected to decrease modestly.

2. Deutsche Bank: Slight Increases Predicted Deutsche Bank expects the headline CPI to be around 0.26% and core CPI at 0.28%, translating to 3.9% and 3.3% YoY, respectively. They note that the core is not expected to fall below 3% and forecast the 3 and 6-month annualized rates to remain above this mark.

3. ANZ: Rise in Core CPI ANZ predicts a 0.2% MoM increase in core CPI for December, with a similar rise expected in headline inflation. However, they caution about the potential downside risks due to energy price volatility.

4. NBF: Expecting Price Increases NBF forecasts a 0.2% monthly increase in prices, driven by rising food and shelter costs, albeit with a decrease in the energy component due to falling gasoline prices. They expect a rise in the YoY rate from 3.1% to 3.2% and a 0.3% monthly increase in core prices.

5. SocGen: Moderate Increases in Headline and Core CPI SocGen predicts a 0.2% increase in headline CPI and a 0.3% increase in core CPI for December. They expect a slight rise in energy prices and a 0.15% increase in food-at-home prices.

6. RBC Economics: Signs of Moderation RBC Economics foresees signs of moderation in CPI growth, with a small increase in the YoY rate of headline price growth to 3.2% from 3.1%. They predict a slowdown in YoY price growth in core products to 3.8% from 4.0%.

7. Wells Fargo: Continuing Slowdown Trend Wells Fargo expects the CPI report to indicate a continuing trend of slowing inflation, positioning the Federal Open Market Committee (FOMC) to start reducing rates in June. They predict a 0.2% increase in headline CPI and a 0.3% increase in the core.

8. Commerzbank: Uncertain Monthly Change Commerzbank anticipates a monthly change in consumer prices of around 0.25%, for both the headline and core rates. They expect the core rate to fall from 4.0% to 3.8%, with a slight potential increase in headline inflation from 3.1% to 3.2%.

9. ING: Soft CPI Report Expected ING predicts a softer CPI report this month, influenced by falling gasoline prices and stable housing rent data. They anticipate the core CPI to fall below 4% YoY for the first time since May 2021.

10. CIBC: Slight Rise in Prices CIBC forecasts a 0.3% MoM rise in both headline and core prices. They note that core goods prices may show a weaker disinflationary trend, while services inflation is expected to decrease slightly.

In summary, there is a general consensus among these major banks that inflation, both core and headline, is on a path of slow moderation. With varying degrees of optimism, these institutions are closely monitoring the trends, underscoring the significance of the upcoming CPI report in shaping economic policy and market expectations. Stay tuned for more updates post the release of the CPI figures.

Leave a comment