As we navigate through today’s economic schedule, several key events stand out, potentially setting the stage for market movements and providing deeper insight into the current economic climate.

The economic calendar begins with a speech by the President of the Bundesbank, providing insights into the current economic thinking at one of Europe’s central banks. Investors will be keenly listening for any hints on monetary policy and economic outlook within the Eurozone.

The spotlight then shifts to Canada with a trio of employment-related releases. First, the Unemployment Rate for January will be closely scrutinized. Following that, the Net Change in Employment will offer a snapshot of job creation or loss, and the Average Hourly Wages YoY for January will shed light on wage inflation, an important piece of the puzzle in understanding the broader economic picture.

Later in the day, a speech by a member of the Federal Reserve will attract attention. With the U.S. central bank’s recent moves and statements having a significant impact on global financial markets, any commentary on the economic outlook or monetary policy can be expected to be closely analysed.

Moreover, an update on the US CPI with updated seasonal revisions will be released, which is crucial for gauging inflationary pressures and could have implications for future Federal Reserve policy decisions.

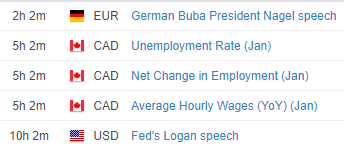

Today’s key economic events include:

- German Buba President Nagel’s speech – 10:30 UTC

- Canada’s Unemployment Rate (January) – 13:30 UTC

- Canada’s Net Change in Employment (January) – 13:30 UTC

- Canada’s Average Hourly Wages (YoY) (January) – 13:30 UTC

- US CPI Updated Seasonal Revisions – 13:30 UTC

- Speech by Fed’s Logan – 18:30 UTC

Investors and analysts will be parsing through the data and statements from these events to guide their economic forecasts and investment strategies. These indicators and speeches are critical for understanding the current state of economic affairs in their respective regions and globally.

Leave a comment