In the dynamic world of foreign exchange trading, understanding the movements and signals within the market is crucial for strategic decision-making. This week’s focus on currency pairs reveals some interesting trends and key levels that traders should keep an eye on.

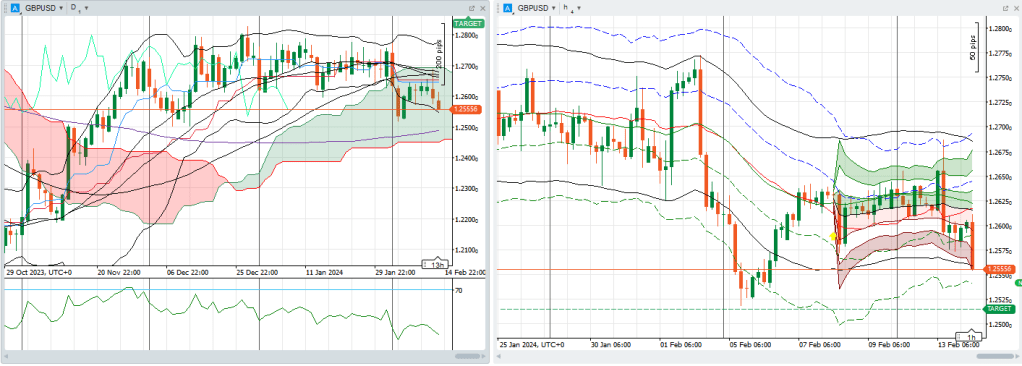

On Tuesday, we observed a firm rejection at the daily cloud top, with the currency pair peaking at 1.2678. This resistance level is significant for traders looking for signs of potential reversals or continuations in market trends.

Our short position, initiated at 1.2670, is showing promising performance. However, for a more confident outlook on the bearish trend, a clear breach below the 200-day moving average (DMA) is necessary. Currently, the 200DMA stands at 1.2565, which has been providing support since February 2nd. A decisive move below this level could signal further downward momentum.

The currency pair has established key support at 1.2518, marking the lowest point reached on February 5th and the low for 2024 so far. This level is critical for traders to monitor, as a break below could open the door to further declines.

In our analysis, we’re targeting a 50% Fibonacci retracement level at 1.2432, which is calculated from the range of 1.2039 to 1.2825. The Fibonacci retracement is a popular tool among traders to identify potential reversal points in the markets.

The fourteen-day momentum indicator is increasingly negative, suggesting that the bearish momentum in the currency pair is gaining strength. Additionally, the Relative Strength Index (RSI) is on a decline, further supporting the bearish outlook.

A critical level to watch in the short term is the squeeze point at 1.2618, coinciding with the 10-day moving average (10DMA). This level could act as a temporary resistance, and a move above could suggest a short-term bullish reversal, while staying below it would support the bearish trend.

In summary, the forex market is showing signs of bearish momentum with key levels and technical indicators pointing towards potential downward movements. Traders should closely monitor these levels and indicators to adjust their strategies accordingly. As always, it’s important to consider multiple factors and conduct a comprehensive analysis before making any trading decisions.

Leave a comment