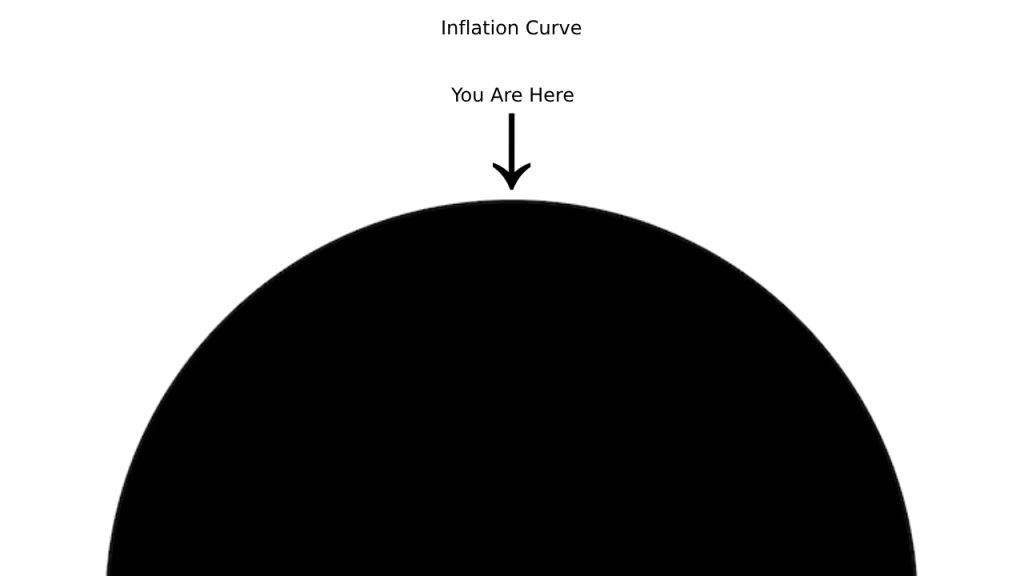

In recent times, conversations around the economy have pivoted sharply towards one phenomenon: inflation. This term has been on the tongues of policymakers, economists, and the general public alike. But what does it truly entail, and where do we find ourselves on the inflation curve?

The inflation curve is a conceptual representation of the inflation rate over time. It serves as a barometer for the economy, providing insight into the purchasing power of our currency and the health of economic activities. Typically, a healthy economy will experience a moderate level of inflation, which indicates growing demand and a thriving marketplace. However, excessive inflation can signify an overheated economy, leading to decreased purchasing power and potential financial instability.

At the present moment, we are witnessing an interesting phase of the inflation curve. The current economic landscape has been shaped by unprecedented factors such as global pandemics, supply chain disruptions, and geopolitical tensions, all contributing to heightened inflationary pressures. Consumers and businesses alike are feeling the squeeze as prices for goods and services continue to climb.

Understanding where we are on the inflation curve is pivotal for preparing and responding adequately. The positioning can inform monetary policy decisions, such as interest rate adjustments by central banks, to either stimulate spending or cool down the economy. It also impacts individual and corporate financial decisions, from everyday purchasing choices to long-term investment strategies.

One key to navigating this inflationary period is adaptability. Businesses that can quickly adjust their operations and pricing strategies in response to inflation can maintain a competitive edge. Consumers can also adapt by seeking out value, adjusting spending habits, and making informed financial choices.

Another strategy lies in diversification. In times of inflation, putting all your financial eggs in one basket could be risky. Diversifying investments across different asset classes, industries, and geographic locations can help mitigate the impact of inflation.

Lastly, education plays a crucial role. Staying informed about economic trends and understanding the factors driving inflation can empower individuals to make smarter decisions. It also encourages a more informed dialogue on public policies that can address the root causes of inflation.

While we navigate the twists and turns of the inflation curve, it’s essential to remain vigilant, adaptable, and informed. The curve we are on is more than just a symbol of our times; it’s a map that, if read correctly, can guide us through the complexities of our current economic environment. Whether you’re an individual saving for retirement or a business planning for the next quarter, understanding the inflation curve is critical for success in today’s economic climate.

Leave a comment