The Bank of Japan (BOJ) is seemingly on the verge of adjusting interest rates upwards for the first time since 2007. This anticipation stems from the growing market speculation regarding a potential shift in monetary policy, possibly as soon as the upcoming March meeting.

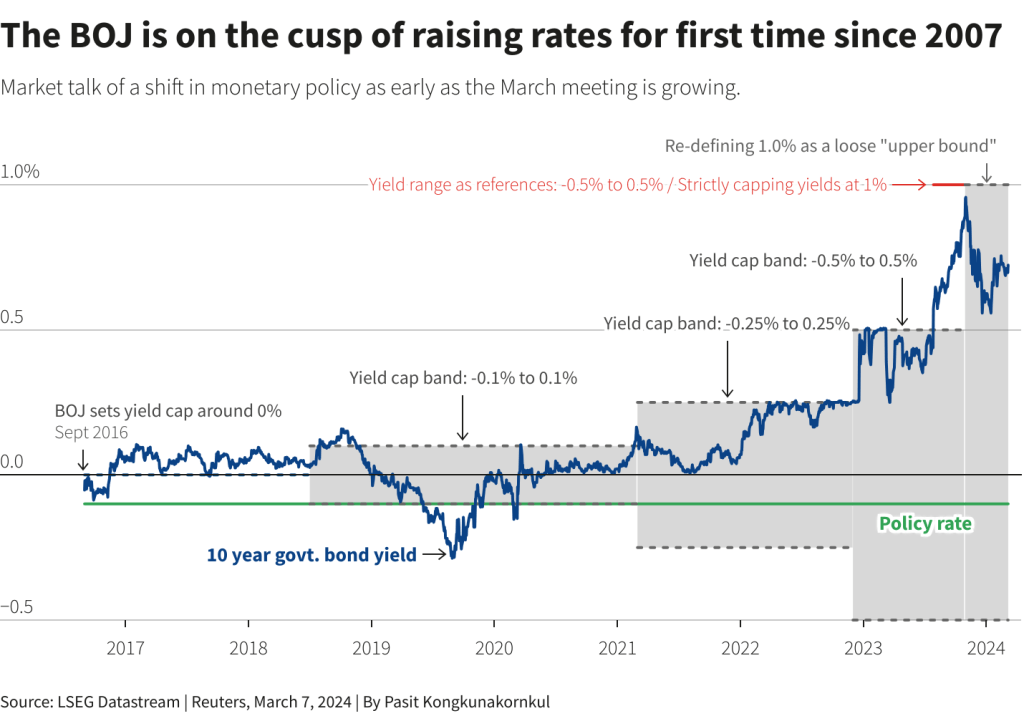

Historically, since September 2016, the BOJ has implemented a yield curve control (YCC) policy to keep 10-year government bond yields around 0%. This was done by setting a yield cap at approximately 0%, meaning that the central bank would buy bonds to prevent yields from rising above that level. The policy aimed to boost Japan’s economy by keeping borrowing costs low.

However, in the face of changing economic conditions, there have been adjustments to the yield cap bands over time. At one point, the yield cap band was defined as -0.1% to 0.1%. It was later modified to a wider band of -0.25% to 0.25%, and then again to an even wider band of -0.5% to 0.5%. These changes have been indicative of the BOJ’s response to varying economic pressures, including inflation and growth dynamics.

Most recently, there has been talk about redefining the loose “upper bound” of the yield range to 1.0%, essentially capping yields strictly at that level. Such a move would mark a significant departure from the near-zero interest rate policy that has been in place for more than a decade.

The possible change in policy is a response to several factors, including inflationary pressures that have started to build up globally. Japan, which has long struggled with deflation, is now considering the implications of a global trend towards higher inflation rates.

The policy rate, which is the rate at which financial institutions can borrow funds from the central bank, has been set below the 10-year government bond yield, indicating an accommodative monetary stance aimed at stimulating economic growth.

As the BOJ contemplates this policy shift, market participants are closely monitoring the 10-year government bond yields for signs of the central bank’s intervention. An increase in the policy rate could have significant implications for the Japanese economy, affecting everything from mortgage rates to the cost of borrowing for businesses, and potentially impacting the exchange rate of the yen.

The anticipation of a rate increase by the BOJ reflects a broader global trend of central banks tightening monetary policy in response to inflationary concerns. This shift by the BOJ could signal a new era of monetary policy for Japan, aligning it more closely with global economic trends.

Leave a comment