The Federal Reserve has a significant influence on the economy through its monetary policy actions, particularly the adjustments made to the benchmark interest rate. Historically, these rate adjustments have undergone various periods of holding before shifting direction, often in response to changing economic conditions. Let’s delve into the durations of these holding periods.

Looking back at the past couple of decades, we observe that the Federal Reserve has gone through several cycles of interest rate hikes followed by holds before eventually cutting rates. These hold periods have varied in length, reflecting the economic context of the time.

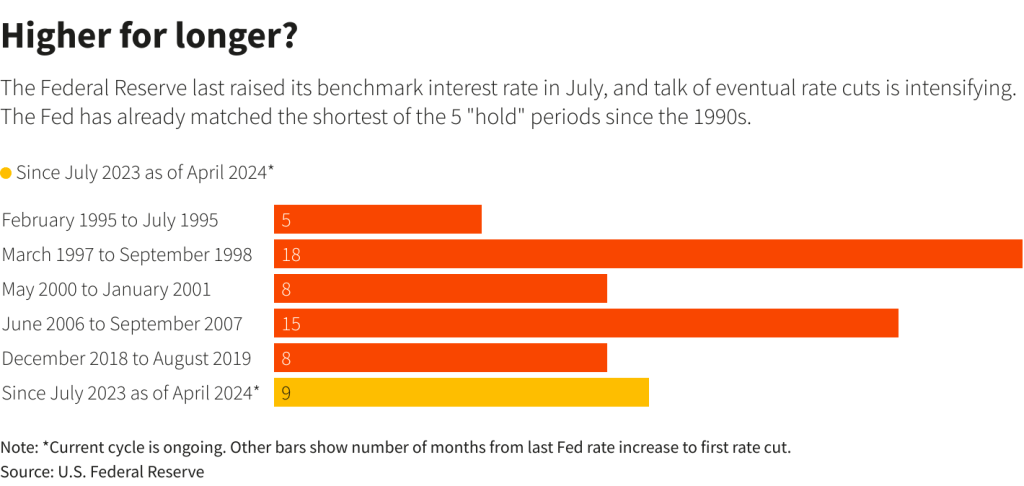

For instance, in the mid-1990s, there was a brief five-month hold period before the Fed transitioned to rate cuts. In the late 1990s, the hold period stretched significantly longer, lasting 18 months. Another notable hold period occurred in the early 2000s and lasted eight months, similar to the duration observed just before the 2008 financial crisis.

More recently, from December 2018 to August 2019, the Fed was in a hold period of eight months before shifting to rate cuts. The rationale behind these adjustments typically ties back to the central bank’s dual mandate to foster maximum employment and stable prices.

The latest cycle began in July 2023 and, as of April 2024, the Federal Reserve has been in a hold period for nine months. The ongoing economic climate suggests that this period may extend even further, with increasing talks of potential rate cuts in the near future.

For investors and market analysts, these periods are critical to monitor as they can signal the Fed’s outlook on the economy. A longer hold period may indicate a wait-and-see approach by the Fed, often employed during times of economic uncertainty or when the effects of previous rate hikes are still being evaluated.

The Federal Reserve’s past and current patterns of interest rate adjustments serve as a testament to the institution’s responsiveness to economic shifts. As we witness yet another hold period, the anticipation of future rate cuts grows, prompting investors to watch the Fed’s next moves closely. The length of these holds not only reflects the state of the economy but also shapes market expectations and investment strategies.

Leave a comment