Recent FX option activity in EUR/USD has revealed some interesting trends in strike demand, volatility, and risk appetite. Here’s a breakdown of the latest market movements:

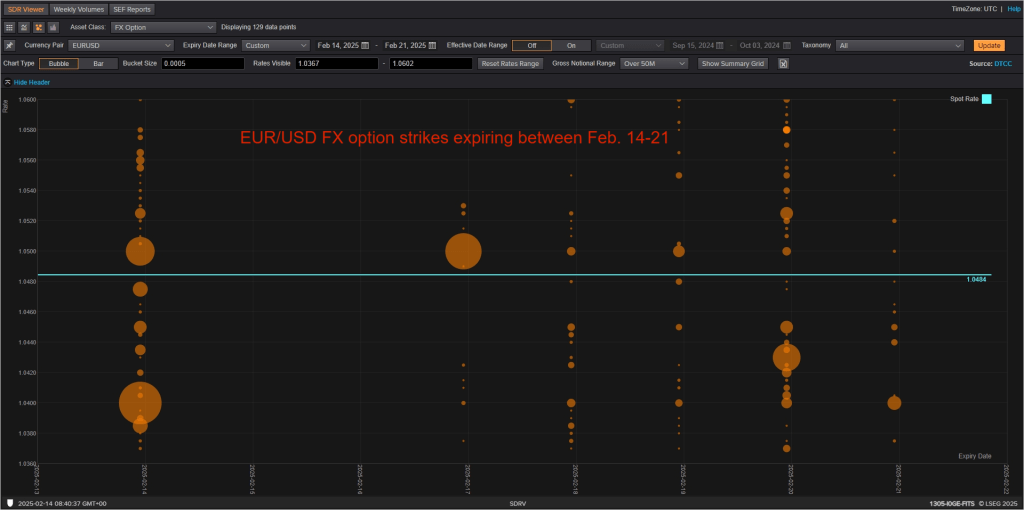

Demand Focused on 1.0450-1.0650 Strikes

Traders have shown consistent demand for EUR/USD option strikes in the 1.0450-1.0650 range. However, there has been little interest in strikes above this level, suggesting a lack of conviction in stronger upside moves for the pair at this stage.

Directional Strikes Indicate Perceived FX Gains

Options traders often use strike selection as an indication of where they see potential gains in the currency pair. The concentration of interest in the lower range could signal expectations of consolidation or limited upside potential.

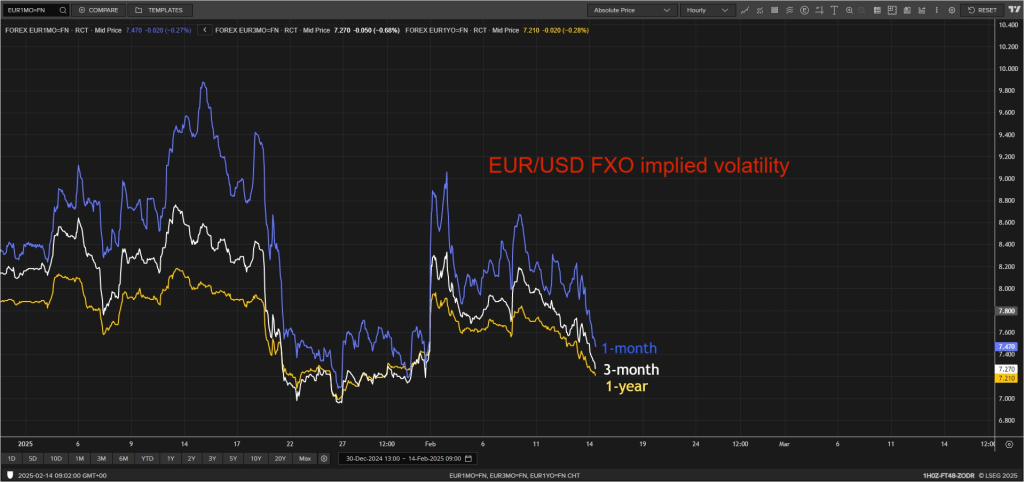

Sharp Decline in Implied Volatility

EUR/USD option implied volatility has dropped significantly, approaching its lowest levels for 2025. This decline suggests reduced expectations for major price swings, which aligns with broader market risk sentiment.

Lower Risk Appetite, Lower Realized Volatility

The recent price action aligns with a risk-on market environment, where investors are less concerned about FX volatility. This has led to a decline in realized volatility, reinforcing the subdued movement in implied vol levels.

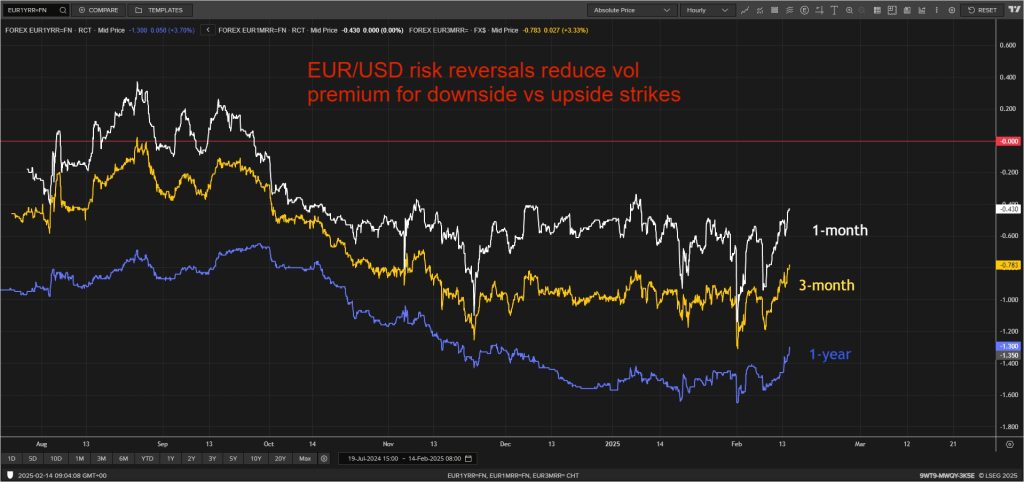

Risk Reversals Shift in Favor of Downside Protection

Risk reversal pricing indicates that downside strike premiums have been further reduced compared to upside strikes. This suggests a less bearish sentiment, as traders are not as aggressively seeking protection against a sharp EUR/USD decline.

Key Expiries: 1.0445-1.0525 Range on Friday

A substantial amount of option strikes will expire between 1.0445 and 1.0525 on Friday, with the largest expiry at 1.0500. This could act as a magnet for spot prices leading into expiry, as traders manage positions around these levels.

The current FX option landscape for EUR/USD reflects low volatility expectations, limited upside conviction, and a balanced risk outlook. With key expiries looming and a focus on strikes below 1.0650, traders will be watching price action closely to see if these trends hold or shift in the coming sessions.

Leave a comment